Most founders start out with a solution idea. All solution ideas contain a problem, sometimes implicitly. In order to not build a startup on a false premise, most startup guides urge founders to validate if the problem exists.

However, you don’t just want to know if the problem exists. You want to learn who specifically has this problem and is eager to solve it. Because only eager customers are likely to buy you.

The fit between the customer and the problem is called customer-problem fit. Identifying high customer-problem fit in your early-stage is crucial for success. Without it, you can’t get to problem-solution fit, let alone product-market fit.

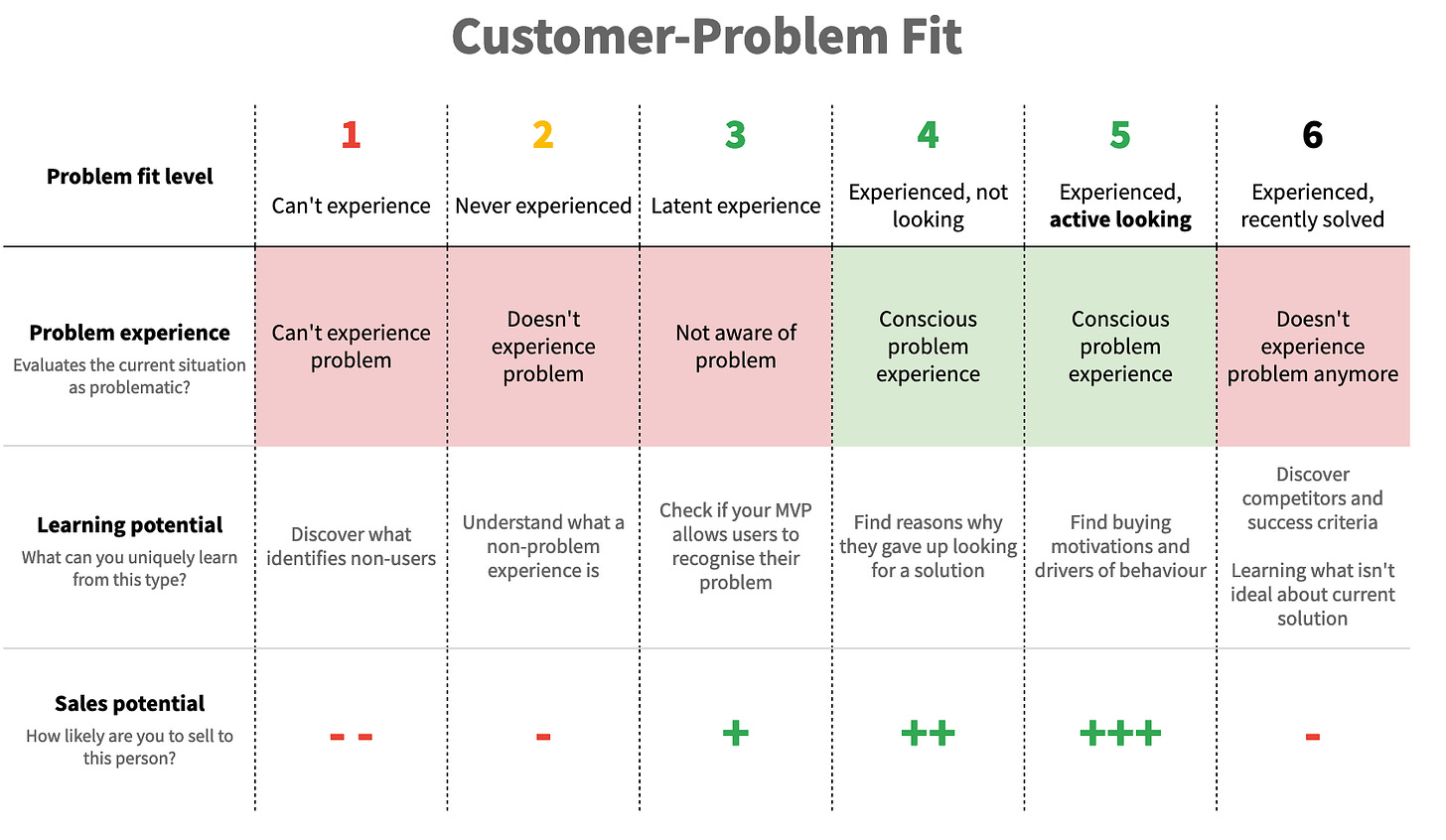

6 levels of customer-problem fit

It can be hard to recognise this fit, especially for first-time founders. To help anyone in this problem discovery phase, I’ve identified 6 levels of customer-problem fit.

Below, I will explain each level with examples.

Case study: 3D printed ski-goggles

Two years ago, founder Sven pitched me the following idea.

Custom-made ski goggles that enable a perfect fit. Their service would make a 3D scan of your face. The goggles’ foam and casing would be 3D printed to seamlessly fit your face.

To validate their problem, they followed the mantra of ‘go where your customers are’. Hence, the team went to the ski supplies store.

Level 1: Can’t experience the problem

In the store, they approached a married couple and asked about their goggle usage. This couple told them they don’t ski or snowboard. They were there to buy hiking gear.

These are non-users. Simple. They are not using the product category, ski goggles. They therefore can’t experience the problem of suboptimal fit.

It’s not an extremely groundbreaking insight, but I use this example since it is so simple: being able to recognise a non-user early on in your conversation can help you to weigh the insights from the conversation.

They learned to start out with the question: “Do you go on winter sport?”, to quickly start the conversation and separate the users from non-users.

Summary

Can’t use your solution

Can’t experience the problem

Sales likelihood: Very low

Learning potential: Find out what separates users from non-users

Level 2: Doesn’t experience the problem

Sven approached another visitor. She responded positively to the winter sports question. When interviewing her about currently owned goggles, this customer didn’t talk about the problem of a bad fit.

Some users just don’t experience the problem. That is okay. Not every one that could technically use your product needs it. But, there is a catch, and that is captured in the next level of customer-problem fit.

Summary

Use the product category

Don’t experience a problem

Sales likelihood: low

Learning potential: Understand what makes it a non-problem experience for them

Level 3: Latent experience

Sometimes, people don’t know they are experiencing a problem. It’s called a latent problem. They don’t talk about the problem by themselves. But, when you talk about your solution, people all of a sudden recognise the problem.

It’s about a problem that they weren’t trying to solve before. Autocorrect on keyboards is nice. We didn’t know touchscreen keyboards could be great until autocorrect helped us.

However, when Sven talked about and showed his solution, the potential goggle customers felt it was not for them. They did say however that they liked it. That is a red flag for mom-test reasons.

Your goal is to let your customer experience what’s in it for them. You should bring something that triggers a response. This can be a verbal pitch, a sketch, prototype or landing page, all for them to realise what’s in it for them.

Summary

Don’t experience a problem consciously

Are able to recognise it when probed

Sales potential: high

Learning potential: Check if your MVP helps to let your customer recognise their problem

Level 4: Problem experienced, but not actively looking for a solution

Next, Sven talked to the store employees, goggle-sellers and the most avid skiers. These were able to list the fit as a key problem. They knew from their sales experience and sales training that this was key for a good goggle experience. Theoretically.

But the ski-sellers themselves were currently not looking to buy new goggles. So here the problem only lived as an idea they use in their sales processes.

There might be many reasons why people recognise a problem but are not trying to solve it. Maybe they already have a solution that works. It could also be that the problem is not big enough or that the problem is not frequent enough.

That is what makes this group interesting: why aren’t these people that are aware of a problem looking for a solution? That is a goldmine for insights.

In the best case, it could be that this group didn’t realise their problem was solvable. If shown the right solution, these people are could be likely to buy your solution.

Summary

Aware of problem

Not looking for a solution right now

Learning potential: Learn about why they are not looking for a solution and understand what a better solution is.

Likelihood to buy: high

Level 5: Problem experienced, active looking

After some problems interviews in the store, Sven went back home. They probed what they could, but couldn’t find people with a pressing issue of misfit of goggles. Maybe the problem wasn’t as pressing?

This is where this framework departs the endeavour of Sven, as he never was able to find high urgency problem owners in this store.

Ideally, you discover people that tell you: “I’m looking to solve this problem”. This is the holy grail of potential customers to talk to. They not only experience the problem, they also are currently looking.

This could be someone walking into that skishop that says: “I’m here to buy new goggles”. Or someone that is browsing the internet with the intent to buy one.

This is the ideal customer to market to. They are not easy to find. Because if they are actively looking, and there are solutions out there, they can find something themselves.

With this group, you can figure out the reasons people want to solve the problem. You can also do this with the previous group, and even with the latent problem experiencers. However, with this group you can identify what makes them keep on looking, these drivers might be more important than general drivers.

Summary

Experiences the problem

Is actively looking for a solution

Learning potential: Find buying motivation and drivers of behaviour

Likelihood to buy: high

Level 6: Experienced, problem solved

Sometimes you encounter someone that had the problem and successfully fixed it. Sven and his team didn’t encounter this specific group.

However, a team I coached last semester did. They are looking at home batteries for solar panel owners in Belgium. Via a Facebook group of solar panel owners, they sourced interview candidates that successfully installed this setup in their homes.

They were able to learn a lot about the process, they seemed enthusiastic hobbyists and tech-savvy people. But, because these users already successfully overcame this issue, there is a low likelihood this team will be able to sell them something that helps to install solar panels and home batteries. Because they already did that.

Note that for some solution types, you can only sell once every many years. People rarely buy 5 houses in a year, or multiple cars. But, people buy clothing or other fast moving consumer goods more often.

Summary

Customer has recently solved the problem

Learning potential: discover what makes a good solution, learn about competing solutions and their limitations

Sales likelihood: low, yet depending on product category

Reflect after every problem interview

What was the customer-problem fit level of this person?

What happened to the startup?

Sven eventually killed the startup. He had issues with finding launching customers and lacked some of the technical capabilities within the startup.

I’ve found a company that has pulled it off, Smith Optics. 3d printed spectacles are also available for swimming and road cycling. Note that road cycling is only some award, couldn’t find a sales page.

Custom 3D printed sporting goggles seem like an emerging market but for now quite tiny.

Warning: beta framework

This is public version 0.3 of the framework. I developed it over the past half year, and used it in various mentoring sessions to see if it works. I used it in two lectures to see if it sticks.

Each of the boundaries of each level can be optimised. I can write in-depth articles about each of the levels and what sets them apart. Work to do here.

I wonder if this resonates with you. Let me know in the comments or below by voting.

How is this framework?

Great - Good - Meh

Voters live longer.

Need 1 on 1 help?

I help founders build products people want and grow their customer base. Can you use some help? Send me an email at ik@jeroencoelen.nl or read some testimonials here.

Share this post