In this edition:

How to answer the question "Is my startup idea viable?"

6 rookie mistakes when it comes to viability

Watch it as a video

Thanks for your great reactions to the video variant of this newsletter. Therefore, I turned this newsletter into a video, too.

Pro-tip: Speaking your story really helps with writing it, read more on this.

Is my idea any good?

To answer this question, there is the following model which we visited last week. Is my idea, desirable, feasible, and viable? This is week two of the three weeks in which we unpack each aspect.

Last week, I unpacked feasibility. I highlighted some key issues with feasibility checking. If you have missed that, I urge you to go back and read/watch it. This week we touch upon the viability of your idea.

What is viability?

The key equation

Asking yourself "Is this business idea viable" probably doesn’t help you. It’s a vague question. To make it a bit more concrete, you can ask yourself:

Will we be able to turn a profit at some point in time?

For that, we have an equation so simple I feel a bit stupid sharing it:

Money in - Money out > 0

If that equation is true, you are currently profitable. It should be higher than 0, yet at the start, you probably aren't profitable. When you start, you often spend more than you make.

Unique for each startup

The outcome of this equation varies over time. While startup A might reach break-even in 6 months, startup B might reach it in 12 months. Some startups never get profitable. It's a long, uncertain grind to become profitable.

You want to generate proof upfront

When it comes to the viability of early-stage ideas, it's about having proof right now that you will be profitable in the future. It's about building an argument on how you expect to break even and turn a profit. You will break down the basic equation. You can do it on the back of an envelope. "I make chairs. Each chair costs me €50 to make, I sell it for €100 and therefore my profit per sale will be €50". This is extremely simple, as time progresses your needs for more advanced proof will develop.

If you just start out, don't bother with making a full dynamic financial model for 5 years. That's overkill. Start simple. There are a lot of tools, calculators, and videos out there that help you with making your first calculations. Check out these:

Easy place to start for a viability check

This video explains most of the variables in the canvas above

A startup calculator optimised for SAAS ideas, great to play around with. Exports to Google Sheets.

Is any profitable idea viable?

So now I reduced viability to profitability. Is that fair? Well, not completely but profitability is an extremely important part of it. Viability also often hints at the depth of the pool you are fishing in. Meaning, maybe you can be profitable for a year but will there be enough customers for the coming ten years?

So viability is not only about being able to be profitable but being able to be profitable in the long run. That is why you spot numbers of market sizes in pitches, to prove that there will be a pool for fishing for customers in the future too. Predicting that can be hard and the proof is often in the eating of the pudding. So let's jump to 6 rookie mistakes early-stage startups face when it comes to viability.

6 mistakes for viability

Sorry for the GIFs

1. "I'm just not a numbers person"

This is something that I face in class yet also when I work with corporates when doing workshops: the sheer avoidance of talking numbers. Numbers can form an objective starting point for fundamental discussions in your startup. You don’t want to avoid those.

The attitude "I'm not just a numbers person" is not very constructive and it will lead to you not understanding your business. How does that look? You can look like this (start at 3:06) clip from Dragon's Den. The founder claims to do revenue of 1.1 million in year 1 and the dragons start to unpack that number. You want to own your numbers better than this. Go try to become good at numbers.

2. Claiming a business model

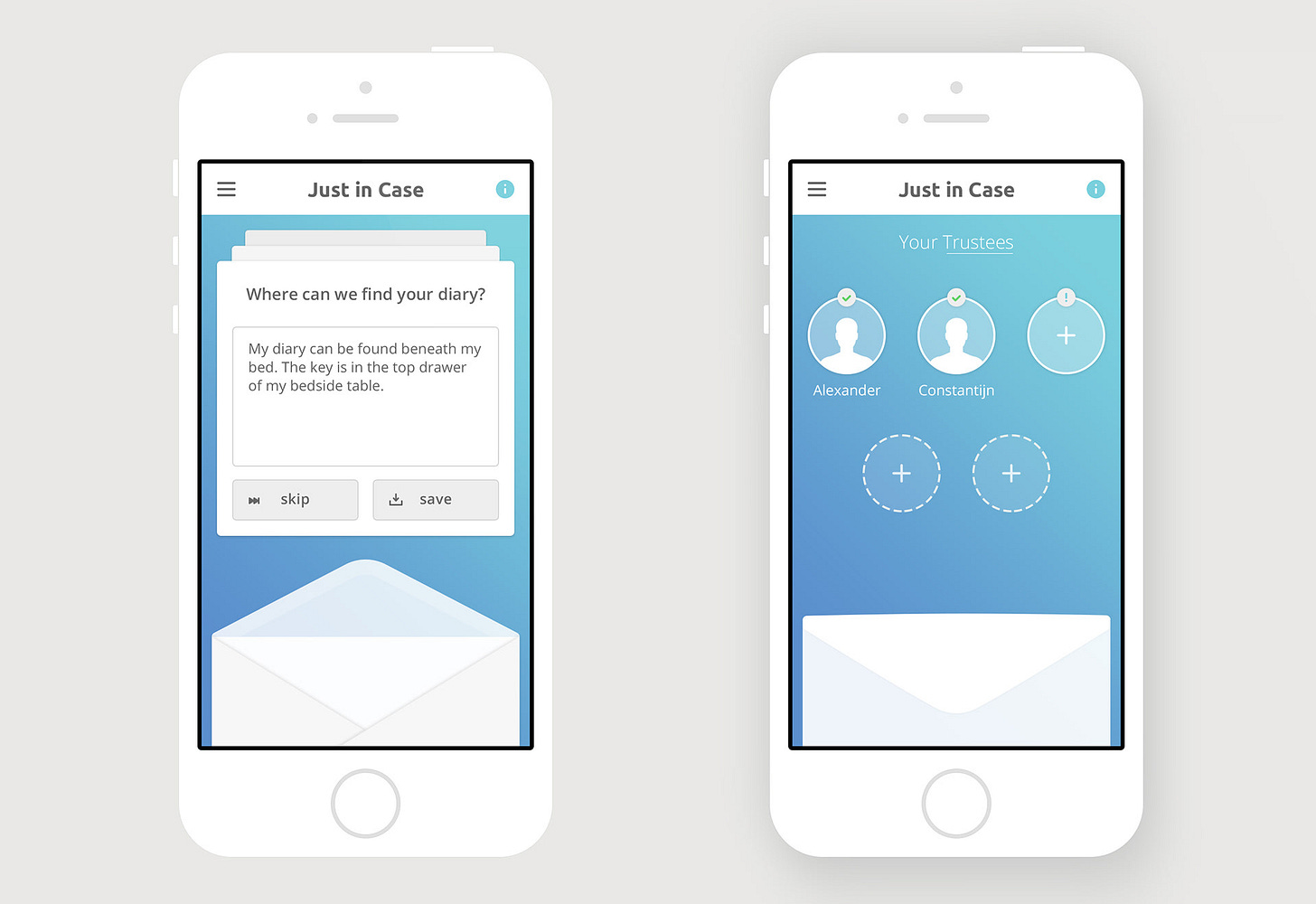

This is an example of my own experience. I did more things wrong than right in my first startup, so you will be seeing examples from that here at Abstract. 7 years ago I did a startup called Just in Case. Let's say you all of a sudden get hit by a bus and you die. Bear with me, to get hit by a bus is not the service that we offered. What happens with all your digital and others accounts? Is there any information you want to pass on to your relatives, such as music for your funeral?

We called this a digital legacy and we made an app for that. You could save this information and we build a technology—technology is a big word, but still—that would only unlock this information when two of your appointed close relatives indicate you actually perished.

We had 3 ideas:

Advertising: Didn’t work because we didn’t have enough users. For this to work users need to be in your app a lot, so you can display enough ads. We figured people only use this app couple of times a year. We couldn't show enough ads to make this viable.

Referral marketing: We didn’t really feel this opion. A “Buy your coffin now?” button? No thanks. Maybe referral to funeral insurance but still that felt a bit too morbid for us.

White label: Dropping our brand and let funeral insurance companies use our app as a digital touchpoint for their customers.

We didn’t settle on a final business model. We just launched. We ‘claimed’ advertising upfront, but we were not able to turn that into actual revenue. We skipped the referral-marketing road and tried to do the white-label strategy. 4 big players dominated that market back then. Cold emailing converted to 1 meeting with a big player. They were interested in entering the digital market. After 3 meetings, a proposal for a deal, and 4 weeks of radio silence, we ended up with nothing.

So, as you validate your solution, you want understand the core of your business model and have proof for it. You cannot claim: "We will do advertising" and expect magic to happen. Again: The proof is in the eating of the pudding. We had a shitty pudding.

Figure out which metrics are important for 9 common business models by watching this video.

3. Sticking to your inner circles

In order to generate proof of viability, trying to get actual sales is generally a good idea. It is very tempting to launch your solution to your friends and family. This happened to two of the startups of recent batches. I will anonymize who they are specifically because I can imagine that you don't want your mistakes flaunted on the internet.

One was in the event industry, the other was in retail products. They started using their own circles and were able to make some sales. But after that, it was hard for them to continue to grow. Online ads didn't really work, then what? Here you see that viability is very closely related to being able to market your solution.

Selling to your own circles doesn't validate a market or your ability to enter it, it might validate that your friends like and support you.

4. Your price is too low

This is not a finding of mine but something that is often stressed by experts on this topic: Most startups underprice their solution. I recommend watching this video on pricing by yCombinator as it addresses this problem very well.

5. Underestimate the cost to sell

The earlier example with the chair that I sell for €100 is not a fair one. I completely left out the costs of selling the chair. Maybe I pay for online ads and it costs me €25 euro per chair to sell. Maybe I spend 3 hours of cold calling random people with a phone book to sell the chair (please don’t do this). Those three hours should be accounted for.

Tip: If it’s your time that you are investing to make sales, keep track of hours and apply minimum wage to get some sense of your sales costs.

Free sales don’t just happen. Obviously, channels that are called 'organic' or 'word of mouth' are great, but that's often a reflection of success. Did you forget to turn on the 'word of mouth' and 'organic traffic' switch for your startup? Doesn't work like that.

6. Listing costs that are not real

You will be creating some simple spreadsheets to do calculations, sometimes based on examples. These are great starting points, but don’t forget to think about what things you are listing.

I've seen numeral times that people start listing 'office space' as a monthly expense because it was there on a template. Even when they had no plans of doing that. While I think Office Space is a great movie, I don't think it's appropriate to say you are renting space if you are not going to.

Don't just put numbers there. Put numbers there that you are actually going to spend and believe are crucial to your success.

How was this article?

Great - Good - Meh

Any vote helps me, makes me smile like a shrimp.

Jeroen’s take

The problem with talking about viability is that very easily you swerve into the territory of desirability, which I will cover next week. The fact that people want to buy your solution, does that make your business viable, desirable, or both? I decided to move all those signals to the next week, so stay tuned.

After this series on the innovation sweet spot trifecta, I have something unique in store. (For me it was quite the rollercoaster)

BTW: Yeah, I went all out with the GIFs. There was a lot of text and I hope to ease the read with these GIFs. Not sure if it’s a keeper. Someone left feedback to add GIFs. I just used that feedback 1 on 1. That’s not always a good idea. Let me know if it was.