VC backed startups don't outperform the industry

And 3 other scientific insights on the funding of startups

Those VC-vest boys don’t know what I got coming for them. Let's go!

1. Do VC funded startups perform better?

A 2013 meta-analysis consisting of a sample of over 32.000 ventures sheds light on this. Meta-analyses are always fun, they are a great conversation starter at parties, trust me on this one.

The evidence from this study was interesting, to say the least. They found that

"Overall VC has a positive, yet, weak effect on the funded firm's performance"

This sounds good, right? Well, this is when they didn't control for industries.

Some industries might be performing very well in general. If your sample of VC-backed companies is biased towards those industries, this might influence the conclusion.

Luckily, statistical analysis can control for this. Then, they arrive at the following conclusion:

"that VCs choose the more promising industries, but are not able to consistently increase the funded firms' performance across all performance dimensions within an industry."

Basically, it's VCs jumping on the bandwagon of promising industries, not startups per se. Ouch. Apply cold water to the burned area.

Note, this sample included various countries (e.g. UK, US, Japan) and mostly companies that IPO'd.

2. Previously funded? Not a good sign.

A more recent study found something else within the semiconductor industry. It discovered that prior funding experience with VCs does not positively affect performance.

The sample size of this study is much smaller than the previous study: it contains 172 US-based firms that received VC funding.

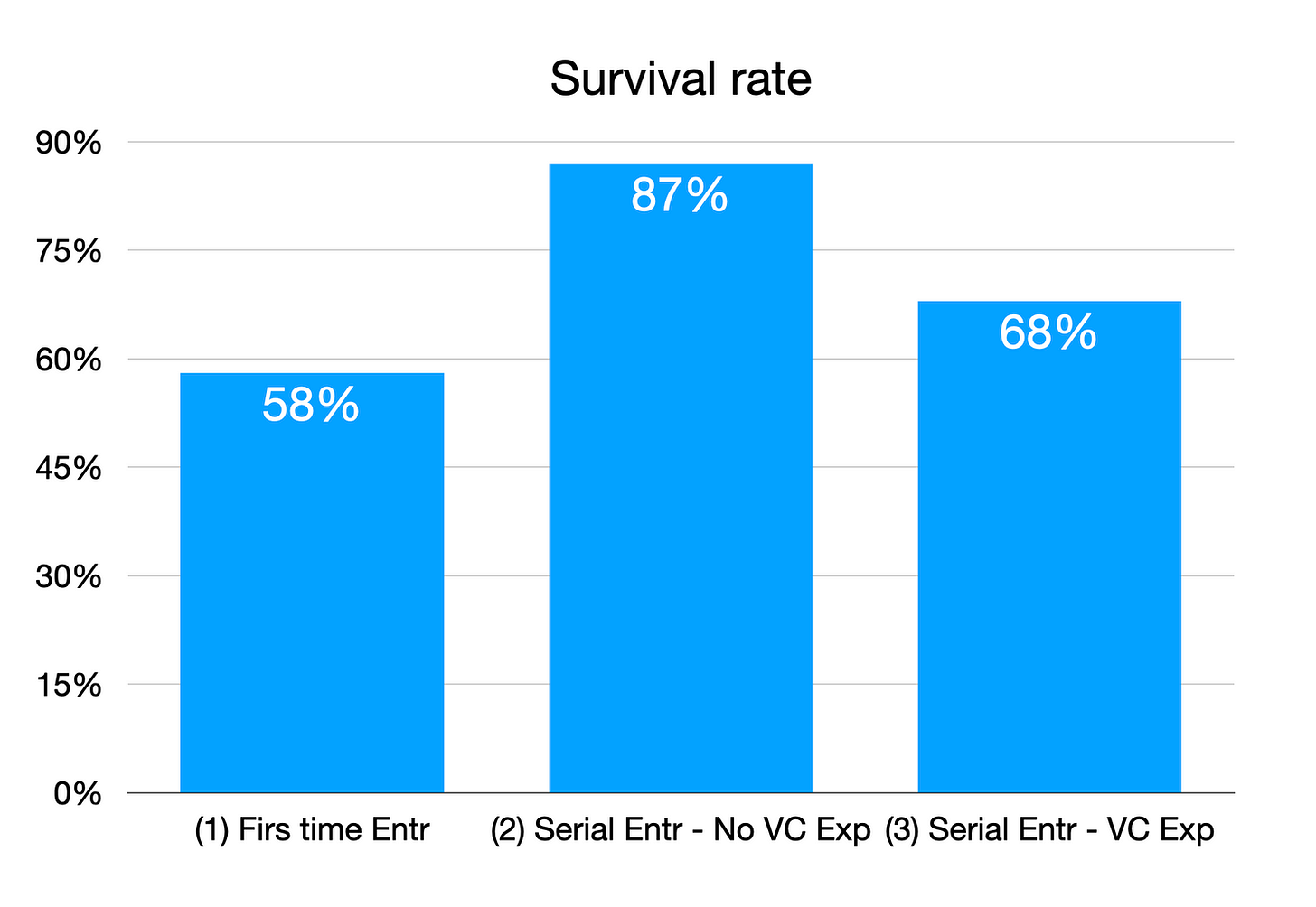

It analysed if the experience of the founder had any effect on the survival rate. They focus on entrepreneurial experience and VC financing experience

Group 1: Firms founded by first-time entrepreneurs.

Group 2: Firms founded by serial entrepreneurs without prior VC financing experience.

Group 3: Firms founded by serial entrepreneurs with prior VC financing experience.

My hunch was for group 3 to have the best survival rate, as they are the most experienced group, both in entrepreneurship and VC-funding.

However, this study found that serial entrepreneurs without VC-funding experience performed the best.

Pushing the right buttons & polishing turds

The researchers discuss that experienced entrepreneurs might have better ties with VCs. The group with previously funded entrepreneurs was able to find funds faster (11 months on average) vs the other entrepreneurs (18 months on average). This shows that they are able to navigate that process better from previous experience.

Furthermore, the researchers argue that entrepreneurs in group 3 probably know how to better pitch their startups to VCs. They understand what to highlight, which buttons to push. They can polish their turd.

The scientist hypothesised: Novice entrepreneurs are selected on the quality of their venture, not the quality of the pitch. Only the best ventures of first-time entrepreneurs get in: no polished turds here.

Does having a successful prior venture influence the survival rate? No. Entrepreneurs who had a successful venture before—defined as IPO or acquired for more than the initial investment—did not perform better.

Note: The dataset is from companies founded in 1995 to 1999. I wonder how that would compare to companies from e.g. 2010.

3. Are failed entrepreneurs more investable?

Within most startup communities, failure is celebrated. Rightfully so, if you ask me, as failing implies learning. Do investors share this view? Is failing a badge of honour to them?

A study published in 2021 investigated this. When raising money, sending your deck to VCs is a common phase of raising capital. They used this as an experiment setup.

To test whether failed entrepreneurs are more or less investable, they designed 12 pitch decks. Some decks highlighted previous failure, some highlighting previous success.

They had a panel of 100 experts with previous investing experience (average of 4 investments) rate these pitches. The result:

"Our findings show that not only does a prior failure lead to negative perceptions of the entrepreneur and their venture, but investors actually view entrepreneurs with a prior failure and their ventures less favorably than if the entrepreneur has no entrepreneurial experience at all."

Shocking. Maybe just talk about your current startup?

4. Is replacing your CEO a good idea?

It's well known that VCs sometimes replace CEO-founders they fund. Sometimes this is regarded as something bad.

Would you like that garage hacker without managerial skills to run your company of 50+ people if you invest millions? Startup founders and CEOs of growing companies require different skill sets.

Does this actually improve performance? One study found that indeed startups where the CEOs were replaced (sample size is 10.000+, founded between 1995 and 2008) performance improved significantly.

Another study added some nuance here. The survival rate of CEO-replaced startups is worse, but the startups that do survive perform significantly better.

So, yes. It does help. But, read my hot take, below.

🔥 Jeroen's spicy hot take

So, shouldn't you get funded? If that's your takeaway, for sure you should get funded, and get replaced. Sassy. I know.

The variety of insights shows the complexity of startups. There is no simple formula that resembles the simplicity of Newton's law of gravitation. We will never reach that level of precision or prediction for the phenomenon of entrepreneurship.

These studies show generalised patterns, inclinations. For every found pattern, there are anecdotes that refute it.

It would be interesting to see studies that compare VC firms. To see which VCs are best, what they do well. Article for another time?

I can imagine they know what they are doing in VC-land. It's not that we've seen industries grow intensely purely on speculation before, have we?

For yourself, ask what you need the funding for. If you have a need for funding, go for it. You should believe your startup will make it, but maybe not so much extra due to the funding.

I discovered some of the studies in this weeks edition via Professor Ethan Mollick's Twitter. It's a great account to follow in general for research on entrepreneurship.

🗓 Every other week

As you might have seen, I started publishing bi-weekly. Every post takes a couple to a dozen of hours. As my research requires more attention—I'm getting into full data analysis mode right now—I can use the extra hours. Quality over quantity.

Hey you, help me out!

Great - Good - Meh

Just with one click, you can help me. How was this article?