Is your startup disruptive? Do The Disruption Test

Three simple questions tell if you are on the path to disruption

This week, Danny Nathan, creator of the Innovate, Disrupt, or Die newsletter & podcast, shares a guest post. Disruptive startups change markets, but the concept is often only discussed superficially. I’ve touched upon aiming at lower markets to be disruptive, but that is just one aspect. Danny has three simple questions to check if your startup idea is disruptive. Happy reading, and let us know in the comments if your startup passes the disruption test.

—

Most startup ideas don’t begin as obviously disruptive or sustaining. They start messy.

They evolve.

Startups don’t begin with answers. They start with an idea and a hypothesis.

Every disruptive idea begins as a guess that must be validated and developed over time through real-world engagement. How you shape and support an idea defines whether it becomes disruptive or fades away.

Disruptive innovations create new markets by offering simpler, cheaper, or more accessible alternatives to existing products.

Sustaining innovations improve existing products for existing customers, keeping the current market structure intact.

In this article, we'll share:

A 3-question framework to assess whether your idea is truly disruptive

Why most startups default to playing it safe

How to intentionally design for disruption instead of settling for incremental growth

How to use the Disruption Test as a lean, early-stage filter to validate your direction before you commit resources

Key take-away

Why it works like this

Disruptive ideas, by nature, don’t come with clean forecasts or obvious metrics. They require a willingness to explore areas where conventional validation won’t immediately apply. You can’t measure the market for something that doesn’t yet exist.

Most Ideas Drift Toward the Safe Path

And yet, traditional business planning, even in startup settings, often encourages teams to prioritise predictability and near-term validation over risk-taking. Founders who are under pressure to show traction default to building for existing, clearly defined markets because they’re easier to validate (rather than exploring opportunities with uncertain or emerging demand).

The way an idea is shaped and refined by those building it determines whether that idea becomes an industry-shaping innovation or just another solution looking for a problem. Or something in between. Many businesses grow and prove successful without being the arbiters of market-defining change.

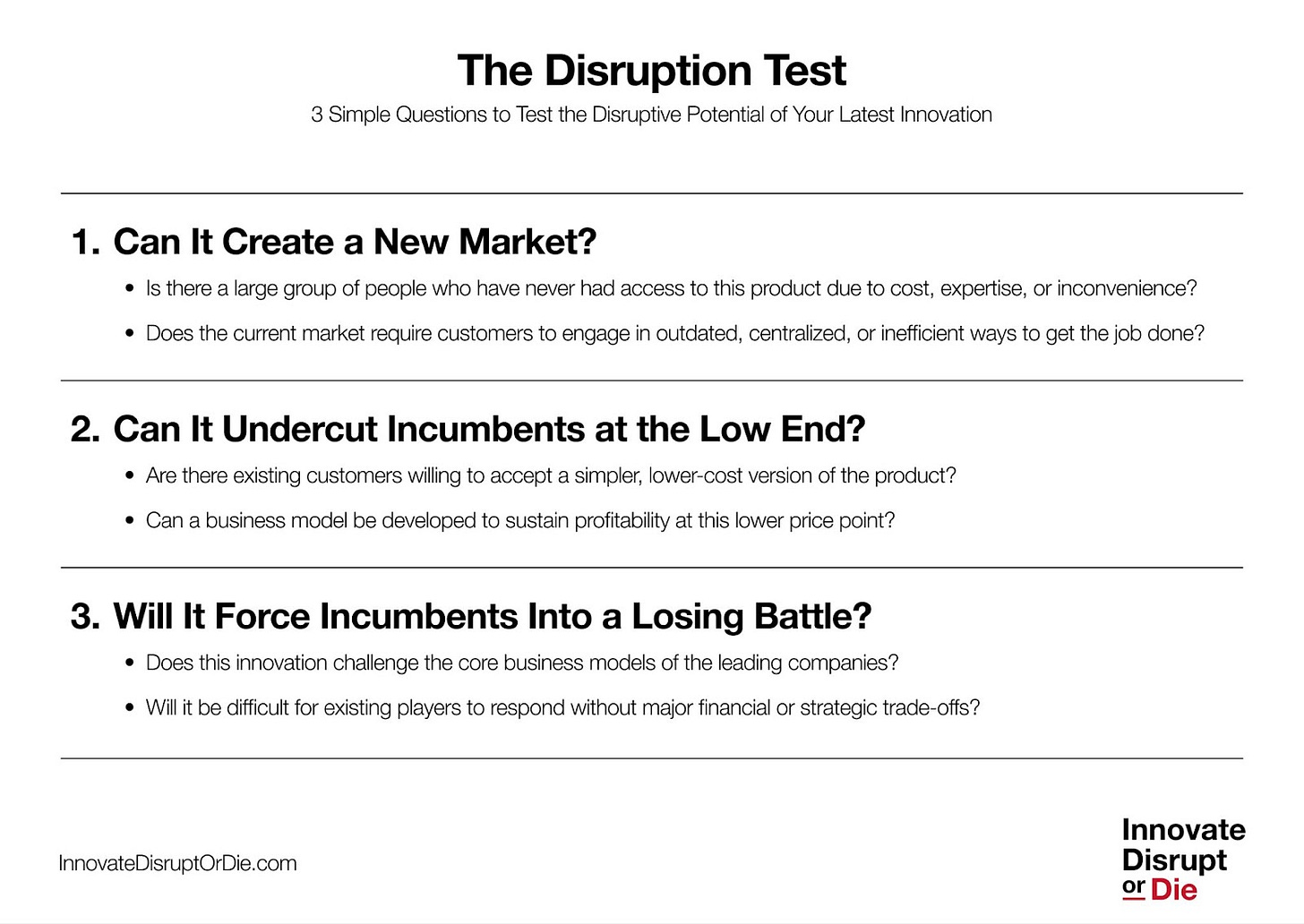

Test the Disruptive Potential of Your Idea with These Three Questions

If you’re chasing product-market fit, these three questions help you avoid building a product that’s just “better” instead of truly different. They’re a lens to spot false positives and discover real opportunity.

To determine whether an idea has truly disruptive potential, all you have to do is ask these three questions…

Do you want to collab, or have me on your podcast? Send me a message by replying to this email!

1. Can It Create a New Market?

The first hurdle an idea must clear is whether it can unlock demand that never existed before. The most successful disruptions come not from competing with existing solutions but from providing entirely new customer segments access to something they couldn’t previously make use of because it was too expensive or too difficult to implement.

To assess whether your idea can create a new market, ask:

Is there a large group of people who have never had access to this product or service due to cost, expertise, or inconvenience?

Does the current market require customers to engage in outdated, centralised, or inefficient ways to get the job done?

For example, Canva opened up a multi-billion dollar market by serving the more than 200 million users that Adobe was not able to capture for years. A classical sign of overserving.

You don’t need a polished product to test this. Start with something simple, like the Brochure Test: a lo-fi experiment where you make a brochure or flyer outlining your idea and use that collateral as a foundation for customer interviews to determine whether you’re on the path to a buyable product.

If the answer to both of these questions is yes, then the opportunity exists to serve new customers in a more accessible, convenient way.

You may have just discovered the seed of an entirely new category.

(But you’re not done yet.)

Putting It Into Action:

Interview potential customers to discover their pain points. What do they do manually or inefficiently that you could help them accomplish more easily?

Search for areas where changes in user needs and technologies have created new market opportunities.

2. Can It Undercut Incumbents at the Low End?

If an idea clears the first stage, it must then prove that it can break into the market in a way that traditional players and incumbents will struggle to counter. The easiest way to do this is to enter at the low end, serving customers who are either overpaying for features they don’t need or those who aren’t yet utilising a similar technology due to cost.

To prove disruptive, your innovation must answer:

Are there existing customers willing to accept a simpler, lower-cost version of the product?

Can a business model be developed to sustain profitability at this lower price point?

The team at Canva realised that not everyone looking to “design” something needs professional-grade tools to bring their idea to life. Instead, they created a simpler, cheaper, easier-to-use design solution to serve people who wouldn’t otherwise pay for Adobe products or who didn’t want to undertake the learning curve necessary to use them. And they offer it at roughly 1/6th the price of Adobe’s products, besides offering a free version with limited features.

The goal is to serve overlooked customers with a focused, cost-efficient model that incumbents can’t match without compromising their own economics because they’re built around old/outdated supply chains and processes. Companies that pass this stage should aim to present a lower-cost product, with potentially fewer features, to serve a segment of the market that incumbents ignore. Over time, once market share is established, the product and feature set can continue to grow, serving more demanding customers at higher price points (and margins).

Putting It Into Action:

Once you’ve discovered a customer need, consider how you might fulfil that need at a lower cost or barrier to entry. Consider how new technologies might enable use cases or solutions that weren’t previously possible.

Craft a business model around the opportunity that focuses on leveraging these lower-cost opportunities.

3. Will It Force Incumbents Into a Losing Battle?

Even if an idea successfully targets a new market AND undercuts incumbents at the low end, it must still pass a final test: Will it fundamentally challenge existing players in a way that they cannot easily respond to?

If an innovation can be absorbed into the industry without disrupting existing players, it is unlikely to create a lasting competitive advantage.

To determine the answer, ask yourself:

Does this innovation challenge the core business/revenue models of the leading companies?

Will it be difficult for existing players to respond without major financial or strategic trade-offs?

For decades, Adobe operated under the following assumptions: the design world is for trained professionals; the average person doesn’t need to design anything; and design tools should be expensive and complex. Canva approached the market by challenging these assumptions and offering an easier-to-use product at a cheaper price-point.

Their bet paid off. They created a $40B market with little impact at all on Adobe’s business. Canva effectively snuck in from the bottom, allowing them to be ignored as a competitor by Adobe. Time will tell whether Adobe responds with new, lower-cost tools.

If an idea forces incumbents to make painful decisions to compete, such as turning their attention from their most profitable customers or overhauling their cost structure, it gives you an edge. Most won’t bother to overhaul their business model to defend the bottom of their target market.

In those situations, disruption becomes your competitive advantage.

Putting It Into Action:

Identify the 5 key players in the market and compare your business model to theirs.

Map the core differences between your product, your business model and theirs.

Ask yourself where you can build additional, deeper moats beyond product differentiation.

What Happens if You Don’t Pass the Test?

An idea that doesn’t pass all three stages is likely a sustaining innovation. It may improve what already exists, but it won’t fundamentally reshape the industry. And while sustaining innovations can still be valuable and offer a decent lifestyle startup, they don’t provide the same opportunity to challenge market assumptions.

For an aspiring disruptor, competing head-to-head with incumbents on their own turf is almost always a losing battle. (Think: Zune vs. iPod, Juicero vs. squeezing really hard, or Quibi vs. YouTube/TikTok.) Large companies have the resources to outbid you in marketing, brand recognition, and economies of scale to win in a sustaining innovation race. Instead of engaging in a battle of incremental improvements, upstarts need to change the rules of engagement to favor speed, simplicity, or access in ways that incumbents can’t match.

This is what makes the Disruption Test essential: it forces innovators to carefully evaluate whether they are truly building something disruptive or simply making an existing product slightly better.

Either is fine, but be aware which boat you are in.

This isn’t just a thought exercise. For founders, the challenge is not just coming up with great ideas but actively shaping them into disruptive strategies.

Don’t just chase product-market fit.

Build toward market creation.

Enjoyed this read?

Check out Danny Nathan’s newsletter & podcast: Innovate, Disrupt, or Die