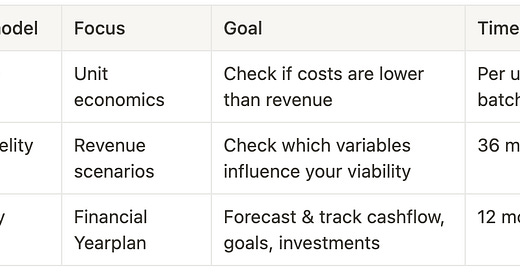

Hate finance? These 3 tools build your startup’s key models for you

From pre-product to full operation

3 core ideas of financial modelling

You make a model for understanding the financial risks

You use that model to understand how your assumptions differ from reality

As your startup becomes more advanced, your models become too

1️⃣ Low fidelity: unit economics

You need to understand if what you are selling costs less than what you are selling it for. Don’t sell a dollar for a penny.

How to do this?

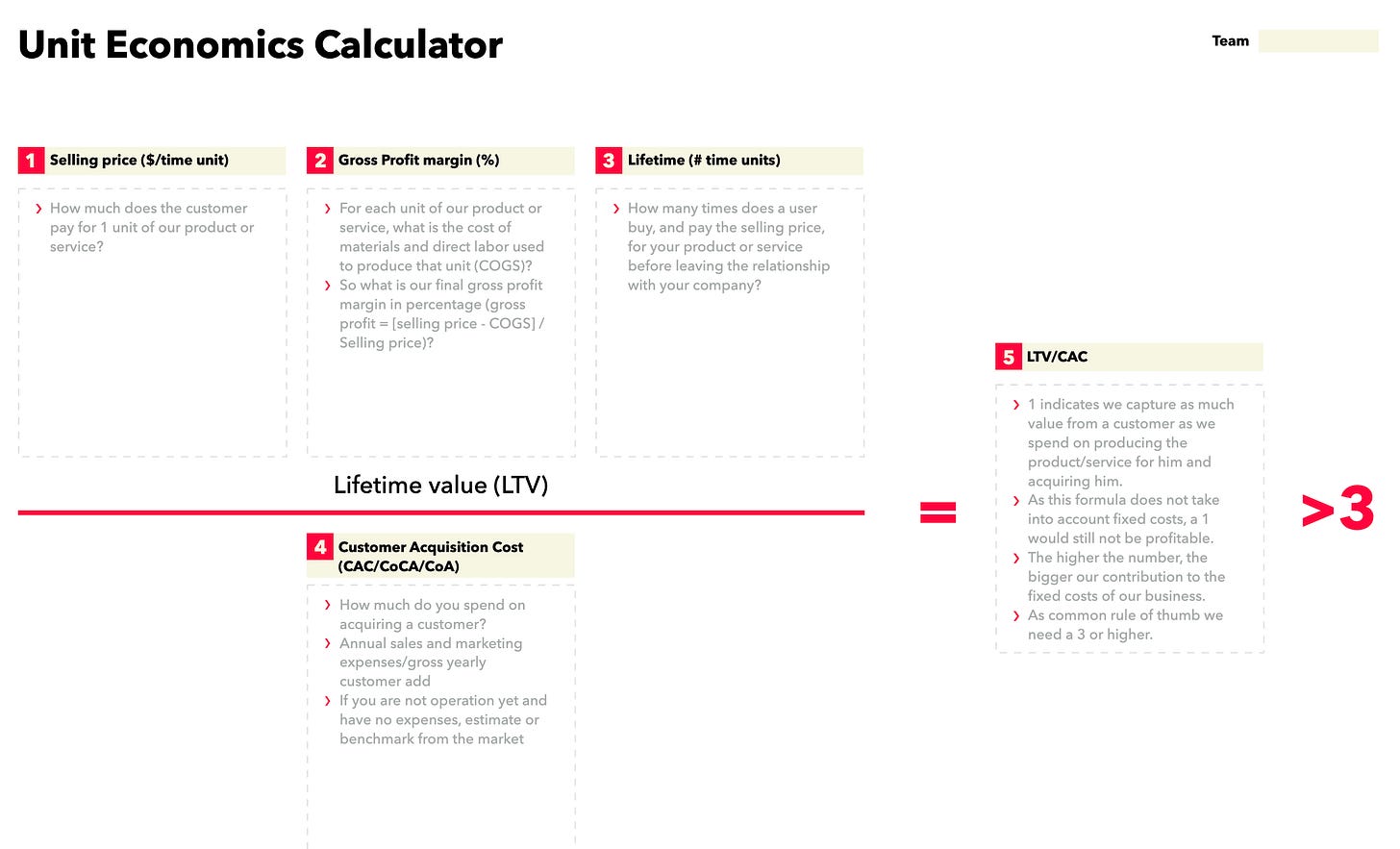

It’s a simple calculation. Board of Innovation has this great canvas. Their Unit Economics Calculator asks 4 simple questions. Let’s use a hotdog as an example.

Selling price per unit: Simple.

Gross profit margin: (selling price - costs/selling price) (it’s a percentage)

Lifetime purchases: how many purchases per acquired customer

CAC: What does it cost you to acquire 1 customer?

Let’s imagine I’ve got a drone hotdog delivery app:

With these ingredients, you can identify if your product is profitable enough to build a business on. The answer at #5 gives a ratio of LTV/CAC, which should be above 3 for a healthy start. Above 5 is amazing; 1 is abandon ship.

Example SuperSola

To make things clear, I use the example of SuperSola. I ran over 10 cohorts of a startup program with its director, Matthijs. For questions on financial modelling, I often turn to him. He helped me immensely with this piece.

Supersola makes and sells solar panels as consumer electronics products. A typical hardware startup. It’s plug and play: put it in outlet, and it works.

Matthijs took on the role of managing director a couple of years ago. The startup was done on problem-solution fit level, and already some early signs of product-market fit were there. Hundreds of panels were sold already. Let’s find out the basic unit economics.

The unit economics today and in three years will look quite different. The gross margin in the early stage is supposedly low: it needs scale to drill down the COGS (costs of goods sold). Likewise, over time, the CAC (customer acquisition costs) could be lowered. But having 4.8 as a result is definitely not bad.

When to do this?

The moment you know your solution. These are basic viability calculations you should do around any product concept the moment you have some clarity on your product.

➡️ Get the Unit Economics Canvas

➡️ Download a great Unit Economics Cheat Sheet by Jasper Wilmes

2️⃣ Medium fidelity: Revenue Scenarios

The next step is to make a simple forecast. You can do this forecast on a Yearly Basis or Quarterly basis; the main premise is that it’s still a rough approximation.

You do this to understand what factors influence your viability. Is your business heavily influenced by your Unit Economics? Or is the expected retention sales more important? Is the initial investment needed in the long run?

How to do this?

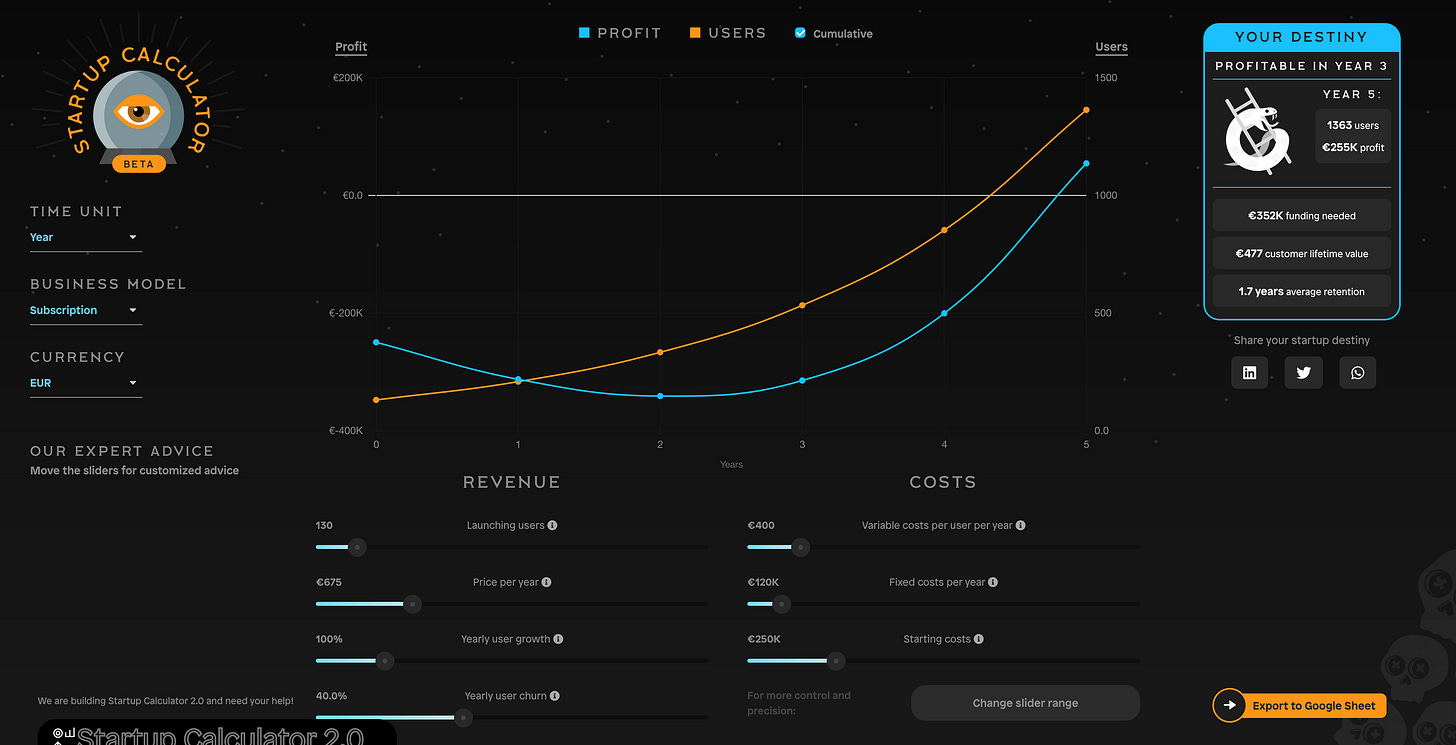

If you already have your Spreadsheet blackbelt, this shouldn’t be hard. However, for others, this might be trickier. The Startup Calculator can give you a head start. Plus, it has an ‘Export to Google Sheet’ feature.

The tool allows you to play around with variables and see the impact on profitability.

Downside: it’s very SaaS focused. So if you have a different type of business, Googling for startup quarterly forecast templates that have a better fit with your business model might help (this page lists a bunch, see what works for you).

Example SuperSola

Matthijs did this type of modeling and quickly understood that focussing on improving the gross margin would be key to creating a sustainable business. The weight of the COGS in the total unit costs impacted the profitability much more than different estimates on customer acquisition costs. One of his first decisions was to raise the price of the product.

When to do this?

If you have some clarity on your product and unit economics, and you are talking to potential customers, you will develop a sense of how hard sales are. Since CAC are very important in these models, it can help to use a model like this to understand where your CAC should be in year 3, for instance.

➡️ Link to Financial Models for each Business Model (Marketplace, SaaS, etc)

3️⃣ High fidelity: Yearplan

At some point your business starts to operate. While in operation, you want to keep proper track of what is happening. You will do investments, you will buy inventory and you need to make sure you are not going bankrupt in the meantime.

Managing and forecasting your cash position is really the top three of things a founder should do on weekly basis. Will a quarter of lower sales kill the product roadmap? Force layoffs? Can you both invest in components and order moulds for your next-gen products in the same month?

The next step is to evolve your quarterly forecast to month-to-month planning. In this, you will include your goals, investments and other things important for our business.

How to do this?

For starting, Excel or Google Sheets is great. Financial software for bookkeeping exists, but often in terms of tax rules is country dependent. There’s many templates out there, a quick Google search gave me this, but you need to check if your startup fits the template needs.

SuperSola Example

When Matthijs took over, he needed to attract investors. For this, he made a financial model to balance ambitious goals with hints of reality but focussed on selling the company.

Supersola produces and assembles components to create their end product. While modeling it quickly became apparent that the lenghty international supply chain makes for a simple statement. It takes a full 100+ days to order - ship - assemble - sell - invoice - get paid. Therefore, every euro spent on inventory can be spent 3 times per year.

It led to a second insight. Halving this 100+ days to 50+ could double the number of units produced. Talk about creating room for growth! So next to optimizing gross margin, optimizing this aspect of the business really gave a boost to Supersola.

This is what such a financial model helps to do. Identifying risks and opportunities.

When to do this?

Cashflow management is important from the start. Detailed forecasts really become essential when you divert from creating your product to preparing to produce and ship your product.

Even lucky founders who secure big investments early on can not skip a week once in a while. Scaling a company day by day also increases the cost of a mistake day by day.

➡️ Free cash flow analysis Google Sheet

You might need to up your excel and accounting game. There’s no harm in getting an external accountant or bookkeeper that helps you with this every now and then. I found one for my business, which set me back couple hundred euros.

SuperSola today

* When I wrote the first version of this piece, Matthijs was the director for SuperSola. Despite the hard work I’ve seen Matthijs going through, SuperSola filed for bankruptcy at the end of this year.

Currently, a reboot is being explored. Matthijs really believes in the product, and part of the cause as Matthijs told me is the cashflow issues as described above. Doing a hardware startup is hard exactly for this reason.